Revenue of $106M, Record End of Quarter ARR of $108M

ARR Surpasses Quarterly Revenue for First Time

Cash Flow From Operations was $19 Million

(Minneapolis, MN, January 31, 2024) - Digi International ® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced its financial results for its first fiscal quarter ended December 31, 2023.

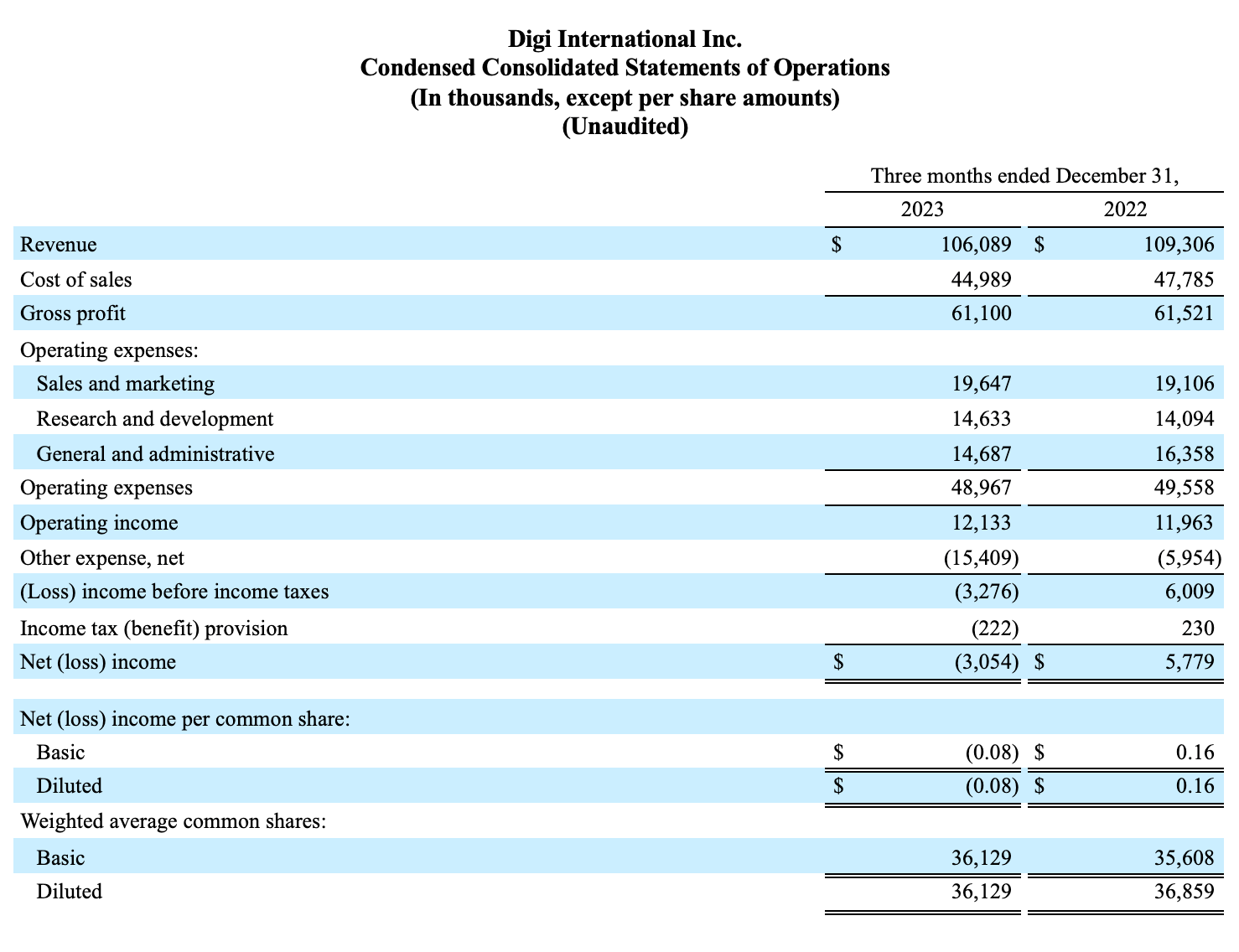

First Fiscal Quarter 2024 Results Compared to First Fiscal Quarter 2023 Results

- Revenue was $106 million, a decrease of 3%.

- Gross profit margin was 57.6%, an increase of 130 basis points.

- Net loss per diluted share was $0.08, driven by the $0.26 impact of the term B debt issuance cost write off, compared to net income per diluted share of $0.16.

- Adjusted net income per diluted share was $0.48, flat year over year.

- Adjusted EBITDA was $23 million, flat year over year.

- Annualized Recurring Revenue (ARR) was $108 million at quarter end, an increase of 13%.

Las conciliaciones de las medidas financieras GAAP y no GAAP aparecen al final de este comunicado.

"Double digit ARR growth propelled Digi to reach a milestone of ARR exceeding quarterly revenue for the first time," said Ron Konezny, President and Chief Executive Officer. "Lowered inventory levels combined with a reduction in debt significantly improved our balance sheet. We are committed to achieving $200 million of ARR and $200 million of adjusted EBITDA within the next five years."

Otros datos financieros destacados

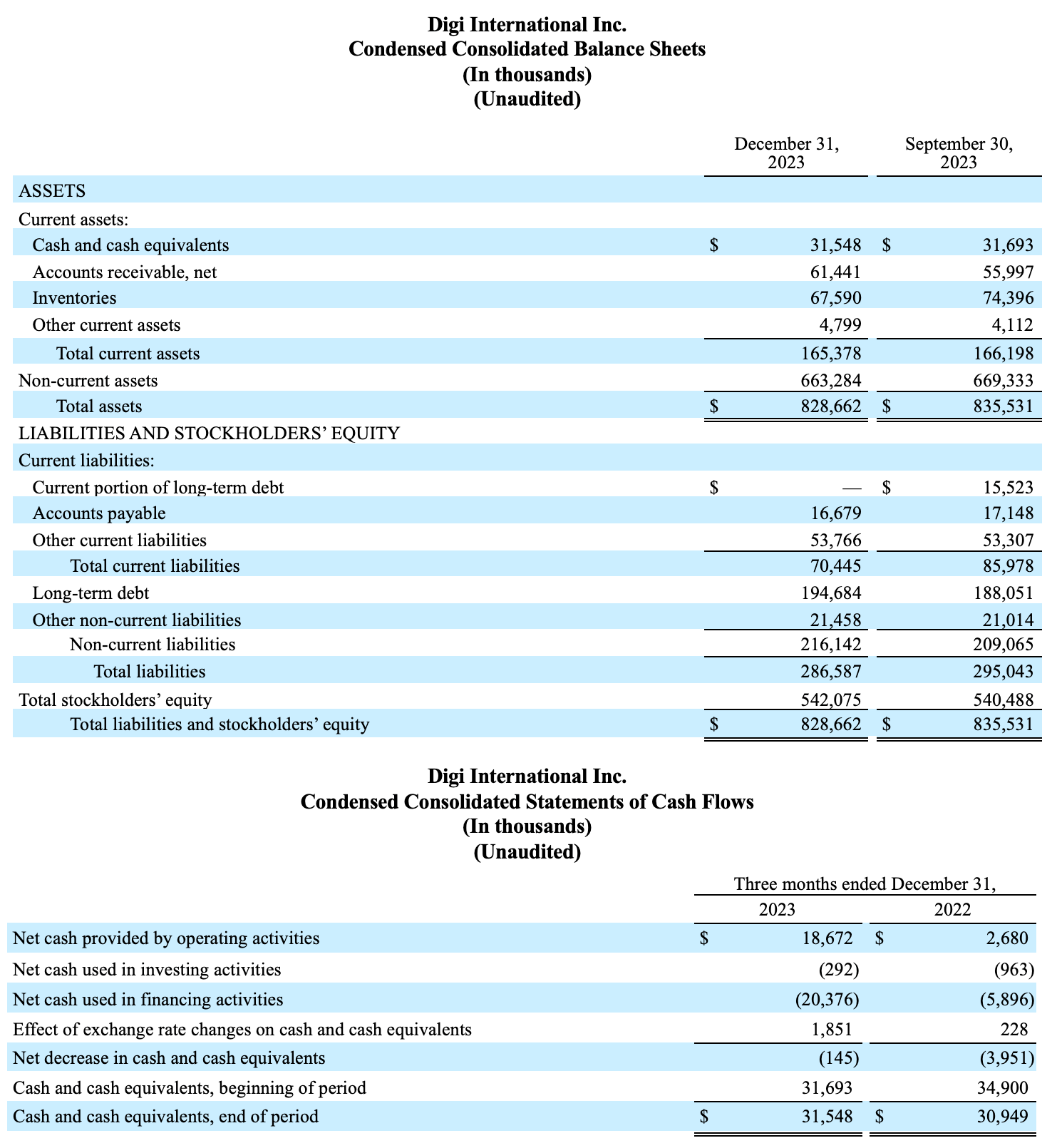

- We retired the term loan existing under our prior credit facility in the first quarter of fiscal 2024, incurring a one-time expense of $10 million for the write-off of debt issuance costs. In addition, we made payments towards our new revolving credit facility, reducing our gross outstanding debt to $196 million at quarter end and debt net of cash and cash equivalents to $163 million.

- We had $5.7 million of interest expense in the first quarter of fiscal 2024, compared to $6.0 million a year ago. The decrease was driven by reduction of our effective interest rate and decreased debt outstanding.

- Cash flow from operations was $19 million in the first quarter of fiscal 2024, compared to $3 million a year ago, driven primarily by year over year changes in inventory.

- Net inventory ended the quarter at $68 million, compared to $74 million at September 30, 2023. This represents a $13 million reduction from the balance a year ago, reflecting continued efforts to manage inventory levels.

Resultados de los segmentos

IoT Productos y servicios

The segment's first fiscal quarter 2024 revenue of $82 million decreased 3% from the same period in the prior fiscal year. This decrease was driven by decreases in sales volume in Console Server and Cellular products, partially offset by growth in OEM products. ARR as of the end of the first fiscal quarter was $23 million, an increase of 64% from the prior fiscal year. This increase primarily was due to growth in the subscription base for Console Server services, complemented by growth in other business lines. Gross profit margin decreased 110 basis points to 53.5% of revenue for the first fiscal quarter of 2024, driven primarily by decreased volume in Console Server, partially offset by increased volume and higher margin mix in OEM. Operating income was $10 million, a decrease of 18%, primarily due to the decrease in revenue.

IoT Soluciones

The segment's first fiscal quarter 2024 revenue of $24 million decreased 4% from the same period in the prior fiscal year. This decrease was a result of decreased sales of Ventus offerings, partially offset by volume growth in SmartSense. ARR as of the end of the first fiscal quarter was $85 million, an increase of 4% from the prior fiscal year primarily driven by growth in SmartSense. Increased revenue and expanding margins in SmartSense drove a 950 basis points gross margin increase to 71.6% in the first fiscal quarter of 2024. Operating income was $1.8 million, compared to an operating loss of $0.7 million a year ago.

Estrategia de asignación de capital

We intend to continue to deleverage the company while managing inventory appropriately as our supply chain continues to normalize. Our inventory position remains elevated, but we believe this investment will deliver working capital benefits for Digi in future quarters.

Acquisitions remain a top capital priority for Digi. We will be disciplined in our approach and act when we believe an opportunity is appropriate to execute in the context of prevailing market conditions. We are evolving and monitoring our acquisition pipeline, and we intend to focus more on scale and ARR.

Second Fiscal Quarter 2024 and Full-Year 2024 Guidance

Digi remains steadfast in achieving our new long term strategic goals of doubling ARR and Adjusted EBITDA to $200 million within the next five years. Digi’s resilient execution in a large and growing Industrial Internet of Things market has stayed consistent. Our outlook for fiscal 2024 remains unchanged, with our ARR and Adjusted EBITDA growing 5% and our revenue projects to be flat year over year.

For the second fiscal quarter, revenues are estimated to be $105 million to $109 million. Adjusted EBITDA is estimated to be between $22.5 million and $24.5 million. Adjusted net income per share is anticipated to be between $0.45 and $0.49 per diluted share, assuming a weighted average diluted share count of 37.7 million shares.

We provide guidance or longer-term targets for Adjusted net income per share as well as Adjusted EBITDA targets on a non-GAAP basis. We do not reconcile these items to their most similar U.S. GAAP measure as it is difficult to predict without unreasonable efforts numerous items that include but are not limited to the impact of foreign exchange translation, restructuring, interest and certain tax related events. Given the uncertainty, any of these items could have a significant impact on U.S. GAAP results.

First Fiscal Quarter 2024 Conference Call Details

As announced on January 19, 2024, Digi will discuss its first fiscal quarter results on a conference call on Thursday, February 1, 2024 at 10:00 a.m. ET (9:00 a.m. CT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Jamie Loch, Chief Financial Officer.

Participants may register for the conference call at: https://register.vevent.com/register/BI5fa5a3d6e5ca4856948123f5f6ddf85e. Once registration is completed, participants will be provided a dial-in number and passcode to access the call. All participants are asked to dial-in 15 minutes prior to the start time.

Participants may access a live webcast of the conference call through the investor relations section of Digi’s website, https://digi.gcs-web.com/ or the hosting website at: https://edge.media-server.com/mmc/p/tn9spd4c/.

Habrá una repetición disponible aproximadamente dos horas después de la finalización de la llamada durante aproximadamente un año. Puede acceder a la repetición vía webcast a través de la sección de relaciones con inversores del sitio web de Digi.

Se puede acceder a una copia de este comunicado de resultados a través de la página de comunicados financieros de la sección de relaciones con los inversores del sitio web de Digi en www.digi.com.

Para más noticias e información sobre nosotros, visite www.digi.com/aboutus/investorrelations.

Acerca de Digi International

Digi International (Nasdaq: DGII) es un proveedor líder mundial de productos, servicios y soluciones de conectividad IoT . Ayudamos a nuestros clientes a crear productos conectados de próxima generación y a desplegar y gestionar infraestructuras de comunicaciones críticas en entornos exigentes con altos niveles de seguridad y fiabilidad. Fundada en 1985, hemos ayudado a nuestros clientes a conectar más de 100 millones de cosas y seguimos creciendo. Para más información, visite el sitio web de Digi en www.digi.com.

Declaraciones prospectivas

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "anticipate," "assume," "believe," "continue," "estimate," "expect," "intend," "may," "plan," "potential," "project," "should," "target," or "will" or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which Digi operates, projections of future performance, inventory levels, perceived marketplace opportunities, interest expense and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to ongoing and varying inflationary and deflationary pressures around the world and the monetary policies of governments globally as well as present concerns about a potential recession, the ability of companies like us to operate a global business in such conditions as well as negative effects on product demand and the financial solvency of customers and suppliers in such conditions, risks related to ongoing supply chain challenges that continue to impact businesses globally, risks related to cybersecurity, risks arising from the present wars in Ukraine and the Middle East, the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, the potential for significant purchase orders to be canceled or changed, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to integrate and realize the expected benefits of acquisitions, our ability to defend or settle satisfactorily any litigation, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring, reorganizations or other similar business initiatives that may impact our ability to retain important employees or otherwise impact our operations in unintended and adverse ways, and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, those set forth in Item 1A, Risk Factors, of our Annual Report on Form 10-K for the year ended September 30, 2023, subsequent filings on Form 10-Q and other filings, could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

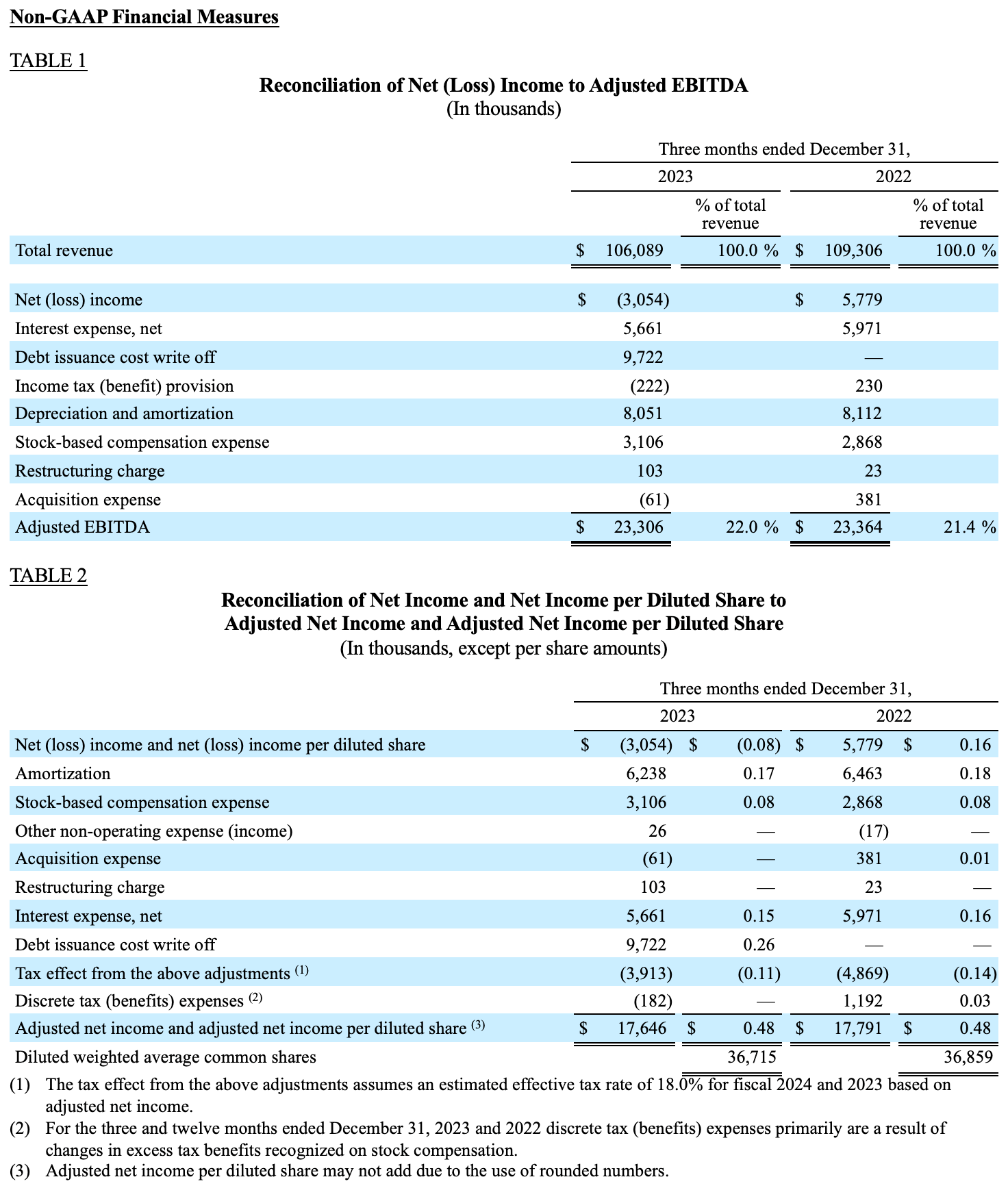

Presentación de medidas financieras que no se ajustan a los PCGA

Este comunicado incluye el beneficio neto ajustado, el beneficio neto ajustado por acción diluida y el EBITDA ajustado, cada uno de los cuales es una medida no contemplada en los PCGA.

Entendemos que hay limitaciones materiales en el uso de medidas no GAAP. Las medidas no GAAP no sustituyen a las medidas GAAP, como los ingresos netos, para analizar el rendimiento financiero. La divulgación de estas medidas no refleja todos los cargos y ganancias que fueron realmente reconocidos por Digi. Estas medidas no-GAAP no se ajustan a los principios contables generalmente aceptados, ni son una alternativa a las medidas preparadas de acuerdo con ellos, y pueden ser diferentes de las medidas no-GAAP utilizadas por otras empresas o presentadas por nosotros en informes anteriores. Además, estas medidas que no se ajustan a los PCGA no se basan en ningún conjunto completo de normas o principios contables. Creemos que las medidas no-GAAP tienen limitaciones en el sentido de que no reflejan todos los importes asociados a nuestros resultados de operaciones determinados de acuerdo con la GAAP. Creemos que estas medidas sólo deben utilizarse para evaluar nuestros resultados de operaciones junto con las correspondientes medidas GAAP. Además, el EBITDA ajustado no refleja nuestros gastos en efectivo, las necesidades de efectivo para la sustitución de activos depreciados y amortizados, ni los cambios o las necesidades de efectivo para nuestras necesidades de capital circulante.

Creemos que la presentación de los ingresos netos históricos y ajustados y de los ingresos netos ajustados por acción diluida, respectivamente, sin incluir elementos como la reversión de las reservas fiscales, los beneficios fiscales discretos, los gastos y reversiones de reestructuración, la amortización de intangibles, las compensaciones basadas en acciones, otros ingresos/gastos no operativos, los cambios en el valor razonable de las contrapartidas contingentes, los gastos relacionados con las adquisiciones y los gastos de intereses relacionados con las adquisiciones, permite a los inversores comparar los resultados con períodos anteriores que no incluían estos elementos. La dirección utiliza las medidas no GAAP antes mencionadas para supervisar y evaluar los resultados operativos y las tendencias en curso y para comprender nuestro rendimiento operativo comparativo. Además, algunos de nuestros accionistas han expresado su interés en ver las medidas de rendimiento financiero excluyendo el impacto de estos asuntos, que aunque son importantes, no son fundamentales para las operaciones principales de nuestro negocio. La dirección cree que el EBITDA ajustado, definido como el EBITDA ajustado por los gastos de compensación basados en acciones, los gastos relacionados con adquisiciones, los gastos de reestructuración y las reversiones, y los cambios en el valor razonable de las contraprestaciones contingentes, es útil para que los inversores evalúen nuestros resultados operativos básicos y nuestro rendimiento financiero, ya que excluye las partidas que son significativas, no monetarias o no recurrentes, reflejadas en los Estados de Operaciones Condensados Consolidados. Creemos que la presentación del EBITDA ajustado como porcentaje de los ingresos es útil porque proporciona un enfoque fiable y coherente para medir nuestro rendimiento de un año a otro y para evaluar nuestro rendimiento en comparación con el de otras empresas. Creemos que esta información ayuda a comparar los resultados operativos y el rendimiento corporativo sin tener en cuenta el impacto de nuestra estructura de capital y el método de adquisición de activos.

Contacto con los inversores:

Rob Bennett

Relaciones con los inversores

Digi Internacional

952-912-3524

Correo electrónico: rob.bennett@digi.com